Identity Guard is an identity theft protection service used by over 38 million to protect their identity.

You choose from multiple plans, then enjoy round-the-clock protection against identity theft and fraud. All plans come with $1 million in insurance coverage against identity theft.

Does Identity Guard live up to the hype? How does Identity Guard protect your identity? Keep reading to find out everything you need to know about Identity Guard and how it works today in our review.

What is Identity Guard?

Identity Guard defends you from identity theft using a range of protection plans. Available for individuals and families, Identity Guard makes it easy to protect your identity, avoid fraud, and act immediately after identity theft occurs.

Identity Guard is priced at $7.50 to $25 per month for individuals and $12.50 to $33.33 per month for families. All subscriptions include access to a US-based customer care team, $1 million in identity theft insurance, data breach notifications, dark web monitoring, high-risk transaction monitoring, and more. Higher-end plans come with white glove fraud resolution, social media monitoring, advanced financial monitoring, and more.

Identity Guard has 20+ years of experience in identity theft and identity theft monitoring. The company has also served over 47 million customers and resolved over 140,000 cases of identity theft.

Overall, Identity Guard aims to protect your finances and personal information with a simple, comprehensive identity theft solution.

Identity Guard Benefits

Identity Guard was founded with the goal of providing three main services, including:

- Protect your finances

- Secure your personal data

- Resolve your fraud cases

To achieve these goals, Identity Guard provides multiple subscription plans with various levels of protection. Whether you want basic identity theft protection or comprehensive protection and resolution services, you can choose from a range of plans to meet your needs.

How Does Identity Guard Work?

Identity Guard provides comprehensive identity theft protection for over 38 million customers. The company uses proven identity theft tools – like monitoring and scanning systems.

Today, the company has enhanced its identity protection tools with the power of IBM Watson, the world’s most recognizable artificial intelligence platform.

Using a combination of artificial intelligence and proprietary scanning tools, Identity Guard scans the internet and checks your credit reports for any signs of unauthorized use or fraud.

As a testament to the company’s confidence in its services, all Identity Guard subscriptions come with $1,000,000 in identity theft insurance. This insurance any losses and fees you experience because of identity theft.

How to Setup & Use Identity Guard

Identity Guard is designed to be easy to set up and use. Whether this is your first time using an identity theft protection service or you’ve used one before, you can start protecting your identity in minutes.

Here’s how to set up and use Identity Guard for the first time:

Step 1) Choose your protection plan. Identity Guard offers three subscription plans for individuals or families. You can enroll online in just a few minutes.

Step 2) Setup identity monitoring. Get notifications if your information is exposed in a data breach or found on the dark web.

Step 3) Remain vigilant against fraud. Identity Guard’s mobile app lets you stay updated on your financial security and identity security. You can link your bank accounts, credit cards, and more to the app to avoid unauthorized purchases. Then, you view and manage everything through your comprehensive Identity Guard dashboard.

Step 4) Get fraud alerts. If Identity Guard detects suspicious activity indicating credit fraud, it sends an alert. Identity Guard claims to send an alert up to 4x faster than the competition. Early action is critical for identity theft.

Step 5) Restore your identity. If your identity is stolen or if someone uses your financial accounts without authorization, then Identity Guard’s team works with you to resolve the situation. The team helps to recover your identity and reimburse funds you lost due to identity theft.

What’s Included with Identity Guard?

Identity Guard includes different items on different plans. However, there are core services included across all plans:

Fraud Monitoring & Alerts: The identity Guard monitors your name, Social Security Number (SSN), and driver’s license number, then sends you an alert if it detects your personal information has been exposed. Identity Guard can send an alert to prevent identity fraud if any of this personal information appears online (say, on a dark web marketplace).

24/7/365 US-Based Fraud Agents: Identity Guard maintains a team of fraud agents available around the clock to walk you through each stage of identity theft. Whether the system has detected identity theft early or you’re dealing with advanced consequences, you have a team working 24/7/365 on your behalf to remediate fraud and support you throughout the resolution process. The team has resolved over 100,000 cases of identity theft to date, and they’re proven experts.

Credit Monitoring & Bank Account Protection: Identity Guard offers credit monitoring and bank account protection, monitoring your credit cards, financial accounts, credit file, and more to detect fraudulent activity. If someone makes an unauthorized purchase, for example, or there’s a sudden deduction from your bank account, you can receive an alert.

$1,000,000 in Identity Theft Insurance: All Identity Guard plans come with $1,000,000 in identity theft insurance. Each Identity Guard plan carries $1 million in coverage to compensate you for any losses and fees incurred as a result of identity theft.

Dark Web Monitoring: All Identity Guard plans include dark web monitoring. If your personal information, credit card information, Social Security Number, and other data appear on the dark web, then you can receive an alert.

High-Risk Transaction Monitoring: All Identity Guard subscriptions also come with high-risk transaction monitoring. You’ll receive an alert if the system detects a high-risk transaction – like a large purchase or a purchase outside your normal habits.

Identity Guard offers three subscription options. The more you pay, the more coverage you get. Additional coverage options include:

Bank Account Monitoring (Included on Total & Ultra): Identity Guard includes bank account monitoring on its Total and Ultra plans. Bank account monitoring monitors your checking and savings accounts for unauthorized purchases or high-risk transactions, then sends an alert.

3-Bureau Credit Monitoring (Included on Total & Ultra): Identity Guard monitors your credit account with all three credit bureaus, helping you stay up-to-date on any unauthorized use of your credit history or SSN. Your Total and Ultra subscriptions include credit monitoring with TransUnion, Experian, and Equifax, the three largest credit bureaus in the United States.

Monthly Credit Score (Included on Total & Ultra): Want to check your credit score? With Identity Guard’s Total and Ultra plans, you can check your credit score each month.

Safe Browsing Tool (Included on Value, Total, & Ultra): Identity Guard offers a safe browsing tool, helping you browse the internet securely. For example, the safe browsing tool can alert you when entering sensitive information into an unknown website or help you avoid phishing scams.

Password Manager (Included on Value, Total & Ultra): Total and Ultra subscriptions to Identity Guard include a password manager. The password manager keeps track of your passwords across multiple sites. Password managers have been shown to reduce your identity theft and fraud risk. You can easily choose different passwords for different websites without writing them down in an unsecured location or making them easy to guess.

White Glove Fraud Resolution (Included on Ultra): All Ultra subscribers receive white glove fraud resolution, which means a specialist walks you through any fraud or identity theft cases appearing on your account. Although all plans include fraud resolution from the customer service team, only Ultra subscribers receive white glove fraud resolution.

Credit & Debit Card Monitoring (Included on Ultra): Identity Guard offers credit and debit card monitoring on its Ultra plans, allowing you to easily monitor all transactions on your credit and debit cards for unauthorized purchases.

401k & Investment Account Monitoring (Included on Ultra): Identity Guard offers 401k and investment account monitoring, helping you keep track of your largest financial accounts.

Home Title Monitoring (Included on Ultra): Identity Guard can keep track of your home title for any unauthorized use or suspicious activity.

Criminal & Sex Offense Monitoring (Included on Ultra): Check if your identity has appeared in any criminal databases or sex offense registries. Someone may have used your identity to commit a crime, and Identity Guard can send you an alert to help you resolve the issue.

USPS Address Change Monitoring (Included on Ultra): Some identity thieves change your address with USPS to steal your identity. All Identity Guard Ultra subscribers receive USPS address change monitoring services.

3-Bureau Annual Credit Report (Included on Ultra): Get an annual credit report from all three bureaus, including Equifax, Experian, and TransUnion, with your Ultra subscription to Identity Guard.

Experian Credit Lock (Included on Ultra): Identity Guard’s Ultra subscription comes with Experian credit lock. Experian lets you lock your credit account to prevent anyone from accessing it, using your SSN, applying for credit, or using it in any way. With your Ultra subscription to Identity Guard, you have access to Experian’s credit lock without needing to pay for the service separately.

Identity Guard Reviews: What Do Customers Say?

According to the official website, identity Guard has over 38 million customers across the United States and is backed by 20+ years of industry experience. Generally, reviewers seem satisfied with Identity Guard, and the service has higher marks than many other identity theft protection services available online today.

Here are some of the reviews shared by verified subscribers across the internet:

Review aggregator website Trustpilot has strong ratings for the company, with 4,450+ customers giving it an average rating of 4.5 stars out of 5. 55% of reviewers have given the business a 5-star rating. Most customers agree Identity Guard provided effective identity protection and excellent customer service, although there are minor complaints about claim resolution and refund processing.

Security.org praised Identity Guard for its affordability, $1 million insurance policy, and AI-based identity monitoring system, scoring the service a 9.5 out of 10 overall. However, they disliked the lack of credit monitoring on the Value plan and the app’s limited functionality.

On ConsumerAffairs, Identity Guard has an average overall rating of 4.2 stars out of 5, with 58% of reviewers giving it a 5-star rating. ConsumerAffairs’ reviewers found the service was effective for monitoring account changes while being easy to use, although they warned advanced plans could be expensive.

Writers at Forbes reviewed Identity Guard in 2023, giving it a rating of 5.0 out of 5. Writers praised Identity Guard for its competitive pricing, discounted annual subscriptions, and use of IBM Watson AI to secure your identity.

Tom’s Guide was less enthusiastic about Identity Guard, awarding the service 3.5 stars out of 5 in a 2023 review. The writer praised Identity Guard for providing solid protection at a fair price, although they found it lacked advanced features of other identity protection services, including malware protection and VPNs. However, the writer was happy with Identity Guard overall, praising it for its social media monitoring, password manager, and two-factor authentication.

Users on Reddit tend to have good things to say about Identity Guard and posts about the service have appeared on /r/personalfinance and other high-trafficked subreddits. Although some recommend simply checking your credit report regularly for similar protection, others find Identity Guard’s protection worth the price.

Overall, reviewers agree Identity Guard works as advertised to provide comprehensive protection against unauthorized transactions and illegal use of your credit report.

Identity Guard Versus Other Identity Theft Protection Services

Identity Guard is comparable to LifeLock and other online identity theft protection services. Generally, customers like Identity Guard for its comprehensive protection, effective fraud resolution, and overall peace of mind.

Here are some of the features that distinguish Identity Guard from LifeLock and other identity theft protection services:

$1 million insurance policy for added peace of mind. Many identity theft protection services offer a similar policy, although some only include it on higher-end plans. With Identity Guard, you get the $1 million insurance policy on all plans.

Data broker removal to reduce the spam and scam calls/texts you receive. Identity Guard scans data brokers who may be selling your information across the internet, then removes your contact information, helping you reduce the number of spam, and scam calls you receive.

Dark web monitoring to scan dark web marketplaces for exposed personal information. Identity Guard includes dark web monitoring on all plans.

Comprehensive identity protection dashboard. Identity Guard makes it easy to manage everything related to your identity and security from a single dashboard.

Safe browsing tools to help you browse the internet more safely. All Identity Guard plans come with safe browsing tools to help you browse the internet more safely, including a safe browsing extension and a password manager. Both can help you expose revealing personal information online.

Stronger reviews and fewer complaints. LifeLock has a surprising number of negative reviews online, including an F rating on the Better Business Bureau and a dismal 2.3 rating on Trustpilot. The company has also faced FTC lawsuits, entering a $100 million settlement agreement with the FTC in 2015 and a $12 million settlement in 2010 after making deceptive claims.

Overall, Identity Guard aims to offer transparent, hassle-free identity theft protection and monitoring services while offering superior value to other top-rated identity theft systems subscriptions available online today.

Identity Guard Subscriptions & Pricing

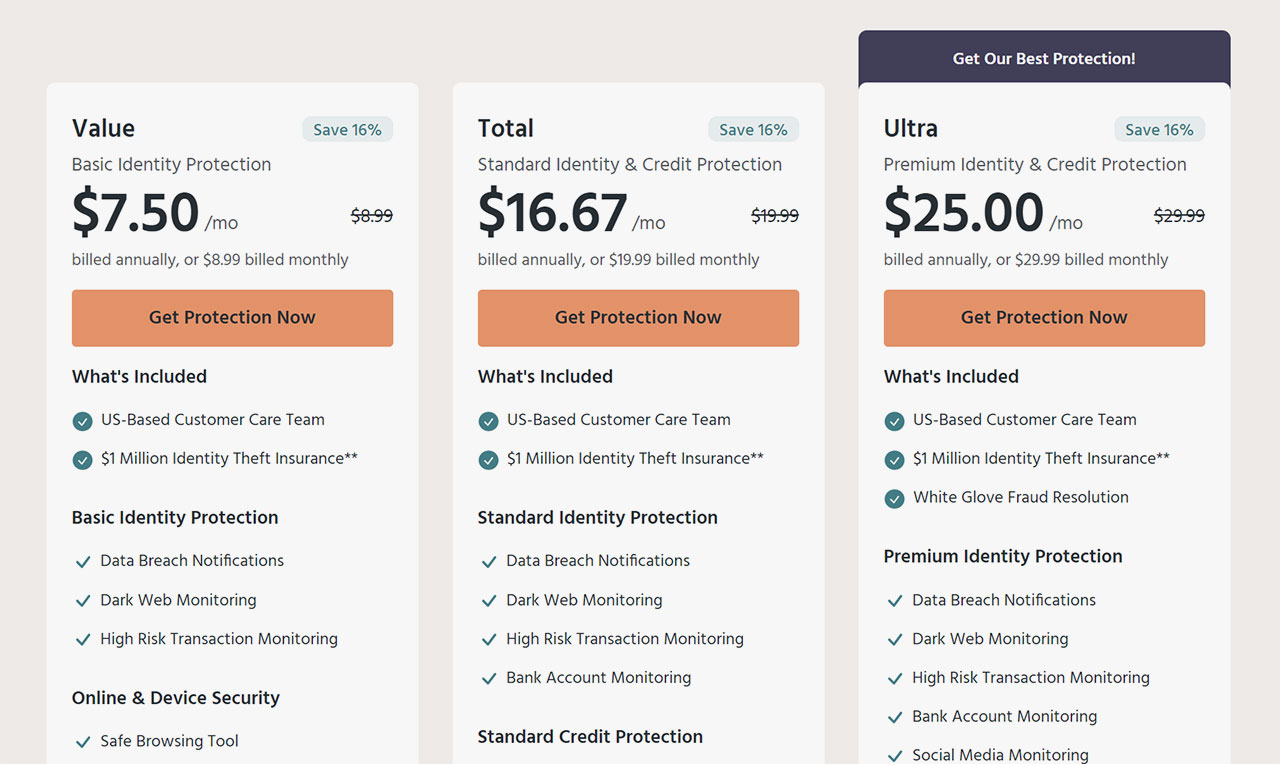

Identity Guard is priced at $7.50 to $33.33 per month, depending on your subscription level and whether you’re buying for an individual or a family.

Here’s how pricing works when ordering Identity Guard online today:

Individual Plans

If you want protection for a single person, then sign up for Identity Guard’s individual plans, which include the following:

- Value: Basic Identity Protection: $7.50 per month (billed annually) or $8.99 per month (billed monthly)

- Total: Standard Identity & Credit Protection: $16.67 per month (billed annually) or $19.99 per month (billed monthly)

- Ultra: Premium Identity & Credit Protection: $25 per month (billed annually) or $29.99 per month (billed monthly)

Family Plans

If you want protection for yourself and your partner, your family, or a larger group, you can sign up for Identity Guard’s family plans.

Family plans include protection for 5 adults and an unlimited number of kids. Plans include:

- Value: Basic Identity Protection: $12.50 per month (billed annually) or $14.99 per month (billed monthly)

- Total: Standard Identity & Credit Protection: $25.00 per month (billed annually) or $29.99 per month (billed monthly)

- Ultra: Premium Identity & Credit Protection: $33.33 per month (billed annually) or $39.99 per month (billed monthly)

Identity Guard Refund Policy

A 60-day money-back guarantee on all annual subscriptions backs Identity Guard. You can request a refund on all Identity Guard annual plans within 60 days if you’re unhappy for any reason.

Identity Guard does not offer a refund on monthly subscriptions. However, you can cancel your subscription at any time without penalty.

About Identity Guard

Identity Guard is one of America’s largest identity theft protection services. Backed by 20 years of experience, the company has more than 38 million customers today, according to the official website. Over the years, Identity Guard has resolved over 140,000 cases of identity fraud.

Identity Guard was founded by engineer and entrepreneur Hari Ravichandran (Founder & CEO). In 1996, Identity Guard’s founding company, Intersections Inc., was one of the first identity theft protection services.

You can contact Identity Guard via the following:

- Email: [email protected]

- Phone: 1-833-692-2187

Final Word

Identity Guard is a subscription-based service offering three plans for individuals and families.

By signing up for Identity Guard today, you can protect your bank accounts, personal information, credit account, and more, then manage everything from an all-in-one dashboard.

To learn more about Identity Guard and how the service works or to sign up today, visit the official website at IdentityGuard.com.

Affiliate Disclosure:

The links contained in this product review may result in a small commission if you opt to purchase the product recommended at no additional cost to you. This goes towards supporting our research and editorial team. Please know we only recommend high-quality products.

Disclaimer:

Please understand that any advice or guidelines revealed here are not even remotely substitutes for sound medical or financial advice from a licensed healthcare provider or certified financial advisor. Make sure to consult with a professional physician or financial consultant before making any purchasing decision if you use medications or have concerns following the review details shared above. Individual results may vary and are not guaranteed as the statements regarding these products have not been evaluated by the Food and Drug Administration or Health Canada. The efficacy of these products has not been confirmed by FDA, or Health Canada approved research. These products are not intended to diagnose, treat, cure or prevent any disease and do not provide any kind of get-rich money scheme. Reviewer is not responsible for pricing inaccuracies. Check product sales page for final prices.