To trade the forex market, you will need to open account with a licensed broker/dealer. There are multiple forex brokers accepting traders based in Canada, but only few of them are legal.

Only the CIRO (IIROC) regulated forex brokers are legal & safe for Canadian forex traders. If you are depositing your funds into account with any unlicensed broker, then you are doing so at your own risk & there will be limited investor protection.

As per our research into CIRO regulated forex brokers & dealers, Forex.com has good overall score based on 9 metrics that we review in each broker.

Best Forex Brokers in Canada

The following is the list of best forex brokers for traders in Canada.

- Forex.com – Best Forex Broker in Canada Overall

- AvaTrade – Best Forex Broker in Canada for Fixed Spread

- FXCM – Best Forex Broker in Canada with MT4

- CMC Markets – Best Forex Broker for Scalping

- Oanda – Best Forex Broker in Canada for Beginners

We have tracked 9 criteria in our research, which include regulations & reputation of the broker/dealer, trading conditions for majors & other currency pairs, overall trading fees, platforms available, and tradable instruments & other factors.

Below we’ve explained breakdown of our factors for each broker.

1. Forex.com – Best Forex Broker in Canada Overall

|

Forex.com Overall Score: 4.2/5 Minimum Deposit: $100 (with Card or Paypal) Forex.com is a regulated market maker forex broker in Canada. Gain Capital – Forex.com Canada Ltd is an American company and are the parent company and owners of Forex.com trading name.

|

Forex.com Canada is an affiliate (and operates as such) of GAIN Capital Group LLC. USA, who are also affiliates of StoneX Group Inc.

They are a registered investment dealer in all Canadian provinces/territories and are registered to provide derivatives in Quebec.

Forex.com is regulated by the Canadian Investment Regulatory Organization (CIRO formerly (IIROC); & also regulated by the CFTC, USA; FCA, UK; FSA, Japan; ASIC, Australia; & CIMA, Cayman Islands.

Forex.com is also a member of the Canadian Investors Protection Fund (CIPF) so you receive monetary compensation if the broker becomes insolvent.

The typical spread for major like EUR/USD is 1.2 pips with the Standard Account. With Raw Spreads Account, the spreads are from 0 pips, but there is a commission of $7/lot (Standard).

Trading platforms available on Forex.com are MT4, MT5, Forex.com proprietary mobile app & web trader, and TradingView charting platform.

Accounts available on Forex.com are:

- Standard Account – $100 USD minimum deposit (Forex.com recommends $1,000 USD), 82 FX pairs, Market Maker model, spreads only, & API trading.

- Raw Pricing Account – $100 USD minimum deposit (Forex.com recommends $1,000 USD), 82 FX pairs, Market Maker model, spreads plus $7 USD commission per $100k (1 Standard Lot) traded, & API trading.

- MetaTrader Account – This account is similar to the Standard Account, but the main difference is that you can trade on MT5 platform.

Tradable instruments available are 80+ Currency Pairs, about 3,000 Stocks, 15+ Indices, and 10+ Commodities. Leverage on Forex.com depends on the instrument, and account base currency. For example, below are the commonly traded instruments & their contract specifications.

| Instrument | CAD Currency Account | USD Currency Account |

|---|---|---|

| USD/CAD | 1.5% Margin, 1:66 Leverage | 1.5% margin |

| EUR/USD | 4.5% Margin, 1:22 Leverage | 3% Margin |

| US Natural Gas | 22% Margin, 1:5 Leverage | 22% Margin |

|

👍 Forex.com Pros |

👎Forex.com Cons |

|

✔️Gain Capital is CIRO Regulated |

❌Forex.com operates as an affiliate of Gain Capital LLC hence the need operates a market maker business model so they can generate revenue from spread. |

|

✔️Member of CIPF compensation fund |

❌Except you use the Raw Spread account, you face relatively high spreads on the DMA, & Standard accounts. |

|

✔️Proprietary trading platform as well as MT5 (depends on your account type) |

❌High commissions of $7 USD per Standard Lot on Raw Pricing Accounts. |

|

✔️High number of FX pairs for trading. |

❌You cannot trade CFDs on Bonds, ETFs. |

|

✔️TradingView advanced charting available. |

No cTrader platform available |

|

✔️API trading is available |

No MetaTrader for DMA account users |

|

|

Inactivity fees of $15 is charged if the account is inactive for 12 months period |

Visit Forex.com Canada website to read more about their trading products

2. AvaTrade – Best Forex Broker in Canada for Fixed Spread

|

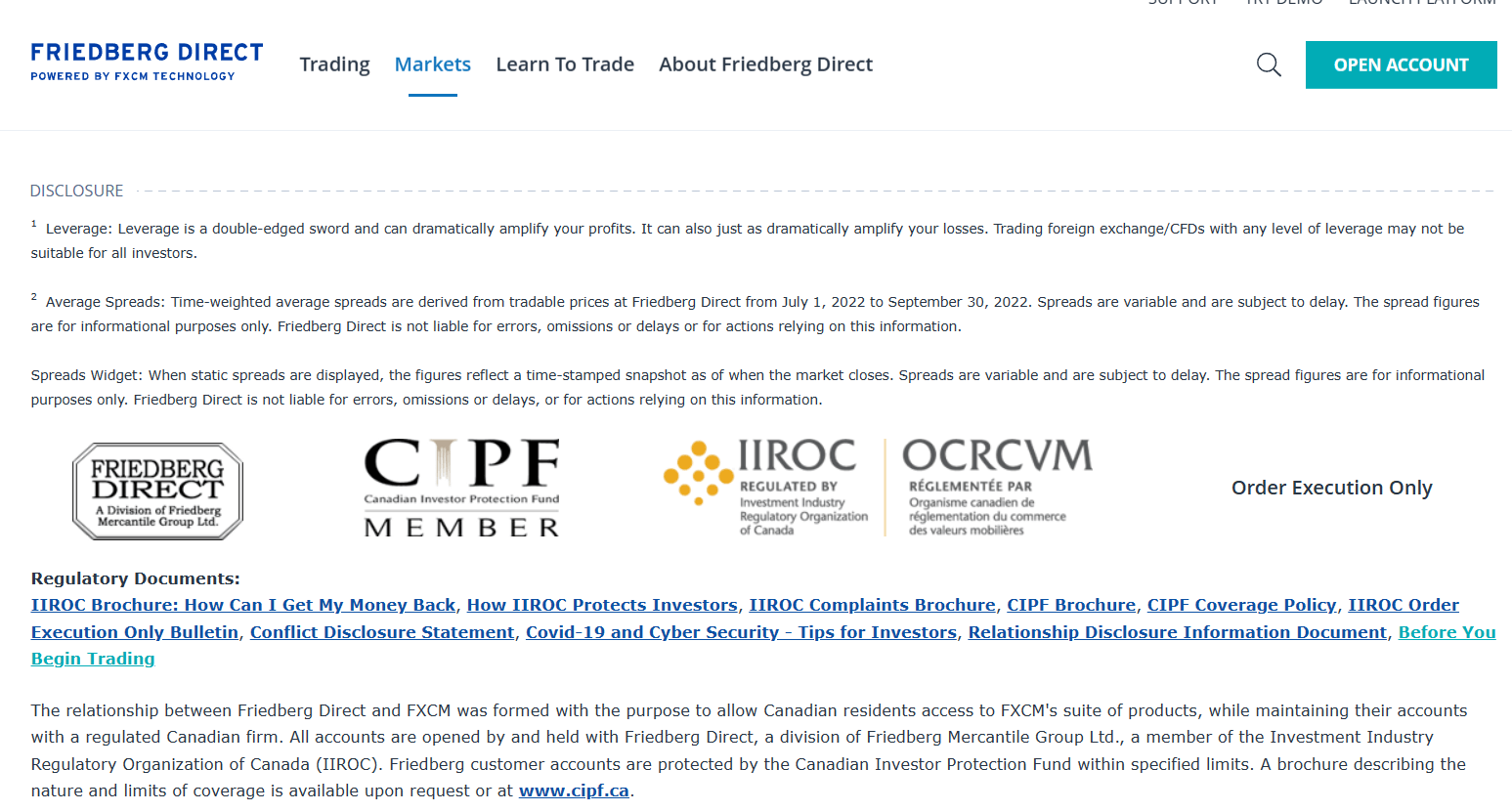

Forex.com Overall Score: 4.2/5 Minimum Deposit: $250 (with Card or Paypal) AvaTrade operates & clears its trades in Canada through an Independent discount forex/CFD broker called Friedberg Direct who are a division of Friedberg Mercantile Group Ltd. All accounts opened are held with Friedberg Direct and subject to their terms & conditions.

|

Friedberg Mercantile group Ltd. are regulated by the CIRO, Canada; and a member of the Canada Investors Protection Fund (CIPF).

AvaTrade platforms are MT4, MT5, as well as proprietary Web, MAC, & Mobile trading platforms. Accounts available on AvaTrade include Standard Account, Retail Account, and Professional Account.

The minimum deposit required is $250 USD or CAD $300. Tradable instruments available are 37+ Currency Pairs, 600+ Stocks, 16 Commodities, 15 Indices, FX Options, and Bonds. Leverage for AvaTrade Canada depends on the instrument you are trading.

| Instrument | Leverage | Average Spread |

|---|---|---|

| USD/CAD | 1.5% Margin, 1:66 Leverage | 1.5 pips |

| EUR/USD | 4.5% Margin, 1:22 Leverage | 0.6 pips |

| Crude Oil | 9% Margin, 1:11 | $0.02 USD |

AvaTrade does not charge commissions but takes a CAD $50 monthly inactivity fee on dormant accounts.

Visit the AvaTrade Canada website for more information

3. FXCM – Best Forex Broker in Canada with MT4

FXCM operates & clears its trades in Canada through an Independent discount forex/CFD broker called Friedberg Direct who are a division of Friedberg Mercantile Group Ltd. This is similar to AvaTrade.

All accounts opened at FXCM Canada are held with Friedberg Direct – a CIRO regulated forex/CFD broker and member of the Canada Investors Protection Fund (CIPF), and subject to their terms & conditions. All derivatives traded by Quebec residents are regulated by the Quebec AMF Authority.

Only the website & technology or backend of the software is powered by FXCM. The clients registered under Friedberg Direct via FXCM Canada may be serviced through an FXCM company.

Accounts available on FXCM include MT4 Standard Account, & MT4 Active Trader Account. Trading platforms available are MT4, and the FXCM proprietary mobile app.

FXCM requires a $50 USD or CAD minimum deposit (minimum account balance must be CAD $5,000 for trading to take place) On Standard Accounts, commission on major currency pairs (including USD/CAD) is $7 USD per side per standard lot, while for minors it is $9 USD per side per standard lot.

On the Active Trader Account, commission is as high as $40 USD per 1 million traded. Margin & leverage are dependent on what is published by the CIRO and is displayed on the Trade Station dealing rates window.

Tradable instruments on FXCM are 23 FX Pairs, 15 Indices, 5 Energies, and 3 Metals.

FXCM Pros

- The broker you are dealing with I.e., Friedberg Direct is CIRO regulated

- Friedberg Direct is a member of Canada Investors Protection Fund (CIPF)

- Relatively low minimum deposit of $50 USD

FXCM Cons

- Operates in Canada through another CIRO regulated broker called Friedberg Direct so your account is actually a Friedberg direct account although you use FXCM software.

- No MT5 platform for advanced traders

- Low number of FX pairs are available

- High commissions of $7 per 100,000 units & trading on USD/CAD, EUR/USD, GBP/USD, USD/JPY, USD/CHF are charged.

- $9 commission per 100,000 units for other currency pairs.

- Monthly inactivity fee of CAD $50

- No cTrader platform

Visit FXCM Canada’s website to read more about their trading conditions

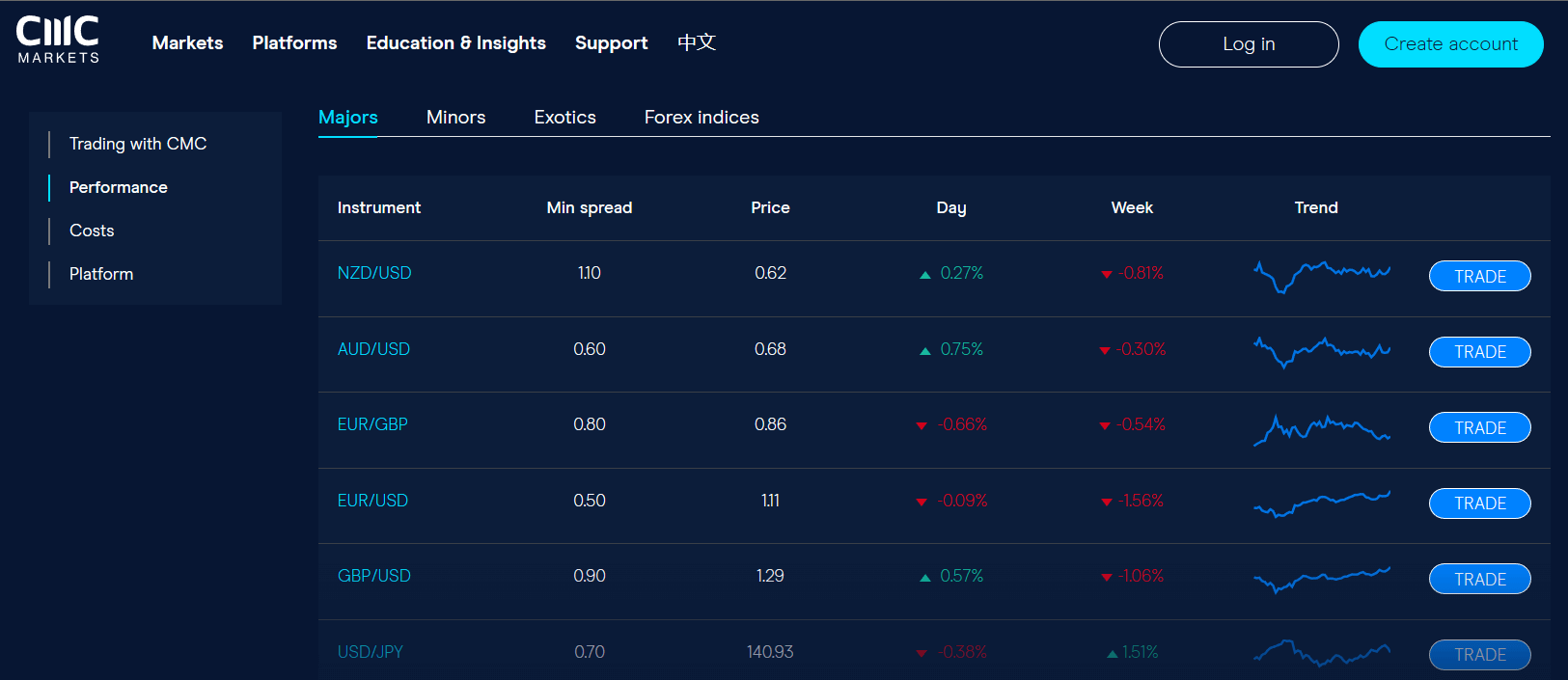

4. CMC Markets – Best Forex Broker for Scalping

CMC Markets Canada Inc. are an CIRO regulated Spread Betting / CFD broker, and are a member of the Canada Investors Protection Fund (CIPF) CMC markets is also a publicly listed company whose shares trade on the London Stock Exchange. CMC only executes your trades and doesn’t provide any active advice.

Platforms available on CMC include the proprietary CMC Next Generation Platform, and MT4. Typical spreads are competitive as can be seen below:

| Instrument | Spread |

|---|---|

| USD/CAD | 1.7 |

| EUR/USD | 0.7 |

| US NASDAQ | 100 |

| Crude Oil West Texas | 2.5 |

| US T-Bond | 3.0 |

Commissions are only charged when you trade Share CFDs but forex CFDs are commission free. There is no minimum deposit requirement it all depends on the payment processor.

Tradable Instruments on CMC Markets are: 330+ FX Pairs, 10,000+ shares, 90+ commodities, 70+ indices, and 40+ bonds. Margin and leverage is instrument dependent as can be seen in the table below:

| Instrument | Margin/Leverage |

|---|---|

| USD/CAD | 1.7% Margin or 1:58 Leverage |

| EUR/USD | 3% Margin or 1:30 Leverage |

| US SPX 500 | 6.5% Margin |

| Crude Oil West Texas | 9.59% Margin |

CMC Markets Pros

- The Group company is CIRO regulated

- CMC Markets is a member of Canada Investors Protection Fund (CIPF)

- Proprietary trading platform

- Commission free forex trading

- No minimum deposit requirement

- Guaranteed Stop Loss Order (GSLO)

- High number of tradable instruments

- No minimum deposit

CMC Markets Cons

- No MT5 & cTrader platforms

- CAD $15 monthly inactivity fee

Visit the CMC Markets Canada website for more information

5. Oanda – Best Forex broker in Canada for Beginners

Oanda (Canada) Corporation ULC, owners of the Oanda trading name are regulated by the CIRO and is also a member of the Canada Investors Protection Fund (CIPF).

Note that OANDA is a market maker & the counter-party to your trades.

Platforms available on Oanda are: MT4, MT5, and the proprietary fxTrade mobile app. There is no minimum deposit to start trading, and Oanda has 5 accounts for you to choose from which are:

- Standard Account – Zero commission, Spreads from 1.1

- Swap-free Account – Zero commission, Spreads from 1.6

- Premium Account – Zero Commission, Spreads from 0.8

- Core Account – $40 USD Commission, Spreads from 0.2

- Premium Core Account – $35 USD Commissions, Spreads from 0.2

Tradable instruments are 45+ FX pairs, 18+ Indices, 3 Metals, 450+ Share CFDs, 8+ Commodities, and 18+ Cryptocurrencies. Margin/leverage depends on your trade volume and exposure.

| Instrument | Below $2M USD | $2M – $5M USD | $5M – $50M |

|---|---|---|---|

| USD/CAD | 0.5% Margin | 1% Margin | 5% Margin |

| EUR/USD | 0.5% Margin | 1% margin | 5% Margin |

Oanda Pros

- CIRO regulated

- Member of Canada Investors Protection Fund (CIPF)

- Proprietary trading platform

- Multiple account options to suit all classes of traders from beginners to pros

- No minimum deposit

Oanda Cons

- Oanda acts as the counter-party to your trades as per their customer agreement.

- Client accounts are registered under British Virgin Island regulation

- No cTrader Platform

Visit Oanda website for more information on their accounts & products

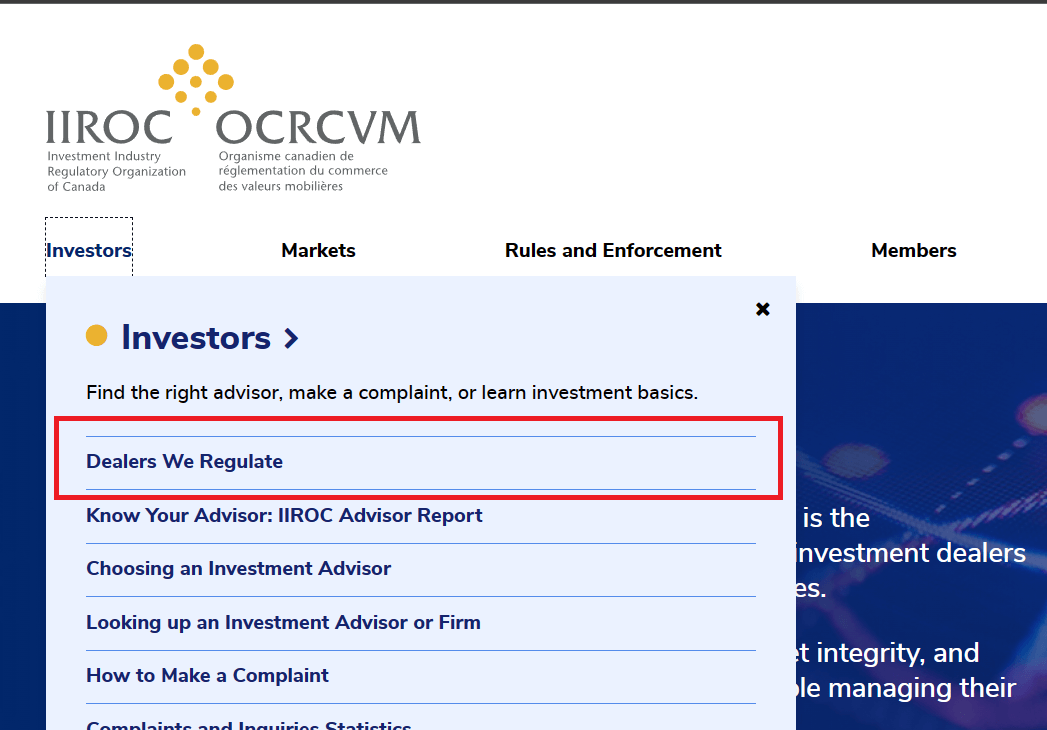

How to Check If a Forex Broker Is Regulated in Canada?

Every forex broker should be registered and issued a license by a regulator of a country. For Canada, this regulator is the CIRO (formerly IIROC).

They issue licenses, oversee broker activities, before considering whether those licenses will be renewed upon expiration.

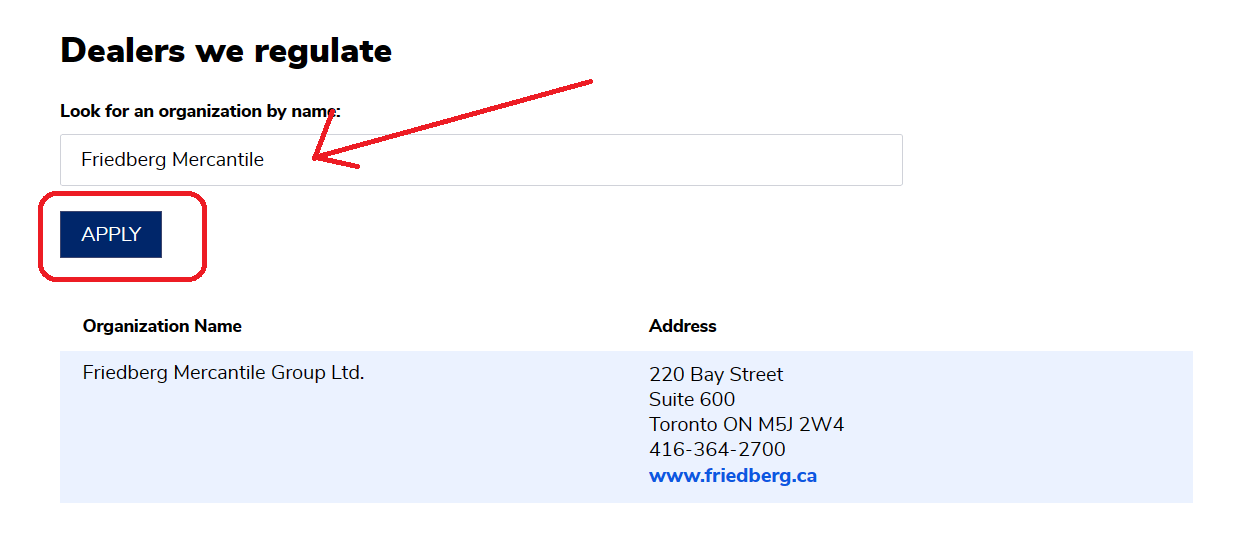

For instance, let us verify the CIRO license of AvaTrade Canada (operating through Friedberg mercantile group Ltd) in the following steps:

Step 1: Visit the website of the regulator “www.iiroc.ca”

Step 2: Look for “Quick Links” and click on “Dealers We Regulate”.

Step 3: Type in the name “Friedberg Mercantile Group Ltd” into the search bar and click on “Apply”. The details of the broker (their address & any terms of their license) will be shown on your screen.

How to Choose a Forex Broker in Canada?

In our research we considered several factors, but these are the important points that you must check & explanation on how you should go about them.

#1 Check if broker is regulated in Canada

Although some brokers are regulated outside Canada, it is only safe to trade with CIRO or IIROC regulated brokers/dealers, because any disputes can be resolved locally.

Also, you will receive investor protection of your funds in case the broker goes under. If you are trading via an unlicensed broker, you risk losing your funds.

#2 Read Broker’s Legal Documents

Brokers have terms and conditions that outline their rights and responsibilities as well as that of their clients. By carefully reading these documents, you will have a clear understanding of the services being offered and the fees and commissions involved.

By reviewing these documents, you can verify that the broker is authorized, licensed, and operates within the legal framework. Legal documents also contain important information such as client agreements, privacy policies, risk disclosure, and broker’s compliance with regulatory bodies.

In addition, reading through the legal documents of brokers will also let you know what jurisdiction your account is registered under, whether it is offshore like an island nation.

#3 Check Trading Charges

You should also check the trading charges such as spread, commission, overnight rollover fees, etc. Example (Part A):

- You open a Forex.com Raw Spread Account that charges $7 USD Commission and overnight rollover rate of -1.02 for a long position of EUR/USD.

- The bid/ask quote for EUR/USD is 1.0970/1.09701 meaning brokers spread is 0.1 pip.

- You buy 100,000 units of EUR/USD pair by paying the ask price of 1.09701 (meaning you spent $109,701)

- You wait one night for EUR/USD exchange rate to appreciate to 1.0975, then you sell your 100,000 units and receive $109, 750

- You make a profit of $49 USD

Part B:

- Subtract the commission of $7 USD, overnight rollover fee for 1 night of 1.02, and brokers spread of 0.1 pip.

- In the end you are left with a profit of ($49 – $7 – $1.02) = $40.98 USD

- So, you lose about 18% of your profit to charges, which is significant. In a different example, this charge can be higher, depending on your account type & trading activity.

#4 Trading Conditions

Checking the trading conditions such as leverage, instruments offered, etc. is important as it directly affects your trading experience and potential profitability.

For instance, if you trade with a small account and capital, higher leverage will expose you to more trading volume, but not without risks.

If your broker offers a variety of FX pairs, you can easily diversify and hedge risk, instead of concentrating your risk on one FX pair. Some brokers allow you to trade from charts like the TradingView charts, which increase you speed and reaction time. Trading conditions should be carefully assessed before choosing a broker as it is the core of trading.

#5 Availability of multiple Platforms

By checking the available platforms, you can ensure that the broker offers a platform that is compatible with your preferred devices (desktop, mobile, tablet).

Different trading platforms a broker could offer may include MT4, MT5, cTrader, etc. When there are different platforms to choose from, you can always switch whenever any of them is unavailable.

#6 Customer Support

Check if the broker has a variety of support channels where you can reach them. Especially look out for live chat, email, as well as social media channels (Instagram, Threads, Twitter, Facebook, Whatsapp, etc.).

Also check if support is available on weekends, & in your preferred language; and if the telephone lines are toll free.

Comparison of the Best Forex Brokers in Canada

See our broker comparison table where important features are listed below for in-depth details

| Broke Name | CIRO Regulated | Minimum Deposit | Max Leverage (Forex) | USD/CAD Average Spread | Tradable Instruments |

|---|---|---|---|---|---|

| Forex.com | Yes | $100 USD | 1:66 | 2.6 | FX, Indices, Stocks, Commodities |

| AvaTrade | Yes | $250 USD or CAD $300 | 1:66 | 1.5 | FX, Stocks, Indices, Commodities, Bonds, FX Options |

| FXCM | Yes | CAD $50 | N/A | N/A | FX, Indices, Energies, Metals |

| CMC Markets | Yes | $0 | 1:60 | 1.7 | FX, Indices, Shares, Commodities, Bonds |

| Oanda | Yes | $0 | 1:200 | 5.1 | FX, Indices, Metals, Share CFDs, commodities, Cryptocurrencies. |

FAQs on Best Forex Brokers in Canada

What is a Forex Broker?

A broker is a financial institution or an intermediary or the counterparty that facilitates the buying and selling of currencies and other financial instruments.

A broker provides key features such as trading platforms, leverage/margin, and overall access to the forex market. The forex broker can be a market maker, as with Forex.com, Oanda etc.

Who is the Best Forex Broker in Canada?

There is no best forex broker, only that the brokers have better trading environment overall. In any case, a regulated dealer should only be considered.

Forex.com is a good forex broker in Canada in the overall category. AvaTrade, FXCM, CMC Markets, and Oanda also good in specific categories.

Which Forex Broker Should I Use?

Use a forex broker that suits your trading strategy.

For instance, scalpers enter and exit the market at short intervals so a broker with zero commissions & very low spreads like CMC Markets is likely better for them because of large volumes.

A forex trader who doesn’t trade often could go for a broker who doesn’t charge monthly inactivity fees & has straightforward trading conditions, accounts.

A trader looking for fixed spreads irrespective of market conditions could use AvaTrade as they offer stable spreads on currencies.

What Forex Broker Has the lowest Spreads in Canada?

AvaTrade Broker has low spreads, and they have fixed spread account. With a fixed spread, you can accurately predict the transaction costs involved in each trade.

Since the spread remains constant regardless of market volatility. Fixed spreads also offer transparency in pricing. You will know the exact spread you will be charged, and there are no hidden fees or additional costs.

What is Forex and CFD Trading?

The meaning of CFD in forex is Contract for Difference. It is simply an agreement between you and your broker to pay whoever is wrong, the difference between the exchange rate movements of a currency pair from the time the contract is open to when it is closed.

CFDs are popular because you trade on the price movements of the underlying asset without taking ownership of it. This instrument is mainly used for speculation or hedging.

If you think a currency pair will appreciate, you buy its CFDs from your broker. You are the buyer, and your broker is the seller (if the broker is the counterparty), so one of you will be wrong and pay the other party the price difference.

What to consider in a Forex Broker?

Here are some points that you should consider in a Forex Broker as a resident in Canada

- Read reviews and check regulation. Canadians should ensure broker is CIRO regulated.

- Ensure broker is a member of the Canadian Investor Protection Fund (CIPF). By doing this, your funds are protected, and you will be compensated if you lose not more than CAD $1M

- Ensure fees charged fit your trading style. Look out for spread, commissions, overnight swap fees, and even inactivity charges on dormant accounts. ECN brokers typically charge tight spreads but higher commissions. Dealing desk brokers charge higher spreads but little or no commissions.

- Ensure the broker offers several trading platforms such as MT4, MT5, cTrader, TradingView, etc. so you can easily switch between them when necessary.

- Ensure there is swift/adequate customer support via many channels. Also ensure a Personal Account Manager is attached to you to help resolve issues one on one.

What forex broker should I trade with in South Africa?

You can trade via any forex broker that is regulated by the FSCA in South Africa, has ZAR accounts, fewer fees and commissions, seamless trading platforms, good and fast customer support etc. You can trade with any broker that fulfils these requirements.

How to open account with a forex broker in SA?

Register with the FSCA regulated broker/entity. Then open your real trading account by completing your KYC.