Investing in gold can be a smart way to diversify your portfolio, reduce your overall risk, and protect your wealth in the long run. Here are the best gold IRA companies in the USA.

Disclaimer: The information provided on this page is for educational purposes only. Refer to a professional for investment advice. In some cases, we receive a commission from our partners. Opinions are always our own.

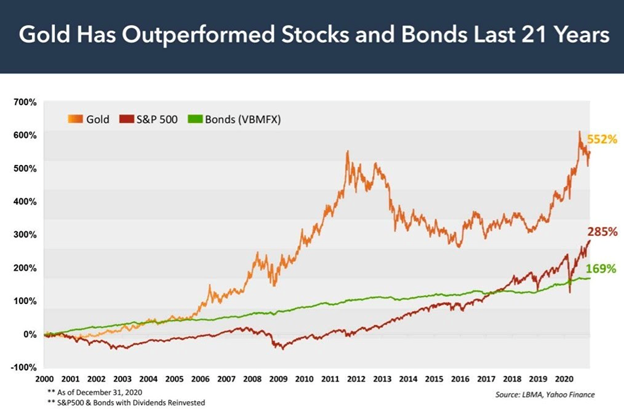

Are you interested in safeguarding your retirement savings from market fluctuations and inflation? Consider a gold IRA as an ideal solution. Gold has consistently demonstrated steady growth in recent years, making it an attractive alternative to the unpredictable stock market. Consequently, an increasing number of retirement investors are turning to gold IRAs to diversify their portfolios and hedge against potential risks.

However, establishing a gold IRA can be a formidable task, involving the selection of a gold IRA custodian, finding an approved depository for storing the precious metal, and navigating complex IRS tax regulations. Fortunately, there are reputable gold IRA companies available that simplify the process for you.

In this comprehensive article, we have meticulously examined and compiled a list of the premier gold IRA companies in the United States. Our evaluation took into account various factors, including their reputation, fees, range of precious metals, and customer feedback. These top-tier gold IRA companies employ specialists who are well-versed in self-directed retirement accounts, providing valuable assistance in setting up your account, acquiring precious metals, and ensuring compliance with tax laws.

Table of Contents:

#1 – Augusta Precious Metals – Overall Best Gold IRA Company for 2023

#2 – GoldCo – Best for Customer Support

#3 – American Hartford Gold – Premier Choice for Retirement Planning

#4 – Birch Gold Group – Best for Small IRA Account

Benefits of a Precious Metals IRA

How to Choose the Best Gold IRA Company for Your Needs

Gold IRA FAQs

Conclusion

Ranking Top Gold Investment Companies

Researching gold IRA companies can indeed be overwhelming due to the numerous options available in the market. To simplify the process for investors, a comprehensive ranking system has been developed to evaluate and identify the best gold IRA companies based on various factors such as customer service, fees, gold selection, and more. These rankings are regularly updated to provide investors with accurate and up-to-date information.

If you’re ready to protect your retirement with precious metals, here are the best gold IRA companies of 2023:

Best gold IRA companies of 2023

Are you looking for the best gold investing firm in America? Augusta Precious Metals is the best gold investment firm in America. Augusta Precious Metals has become a leader in its industry with thousands of 5-star reviews and glowing customer testimonials. Joe Montana, the football legend, turned to Augusta to find out which gold company was best for his financial portfolio. He was so pleased with Augusta that he became an ambassador for the company.

Augusta’s commitment to transparency and education sets them apart from their competition. The public can watch a one-on-one Web conference with a Harvard trained economist who is on staff. This conference offers valuable insight into the world’s precious metals investment.

Augusta also serves as a protector of the industry by helping consumers navigate and avoid common pitfalls. The company offers educational videos such as “Ten Big Gold Dealer Lies” and “15 Bad Reasons To Buy Gold” to help their customers make informed choices.

Augusta’s mission is not limited to education. Augusta offers streamlined, compliant, and transparent steps to their customers. Augusta is a company you can trust to invest in precious metals. They will put your needs first. Augusta is your best choice if you want to invest in precious metals such as gold, silver or any other.

What does Augusta Precious Metals Current Offer?

Augusta ZERO FEES Gold IRA for up to 10 years >

Customer Ratings

What Are The Benefits of Working With Augusta Precious Metals?

Augusta Precious Metals has a wide range of benefits that make it an ideal choice for investors looking for a reputable and trustworthy Gold IRA company. These benefits include:

✅ Recognition and Awards: Augusta has been named the “Most-Trusted Gold IRA Company” by IRA Gold Advisor, and has received the “Best of TrustLink” award six years in a row. This recognition from industry experts and customers alike is a testament to Augusta’s exceptional service and performance.

✅ Excellent Customer Reviews: Augusta has received thousands of 5-star ratings and hundreds of positive customer reviews. These reviews indicate that Augusta’s customers are highly satisfied with their experience and trust the company to handle their investments.

✅ Endorsement by Joe Montana: Augusta is the Gold IRA company of choice for football legend Joe Montana and his team. This endorsement is a strong indication of Augusta’s credibility and reputation in the industry.

✅ High Ratings: Augusta has an A+ rating with the Better Business Bureau and an AAA rating with the Business Consumer Alliance, indicating that the company meets high standards of business ethics and customer service.

✅ Preselected Gold and Silver Coins: Augusta offers a selection of preselected gold and silver coins to choose from, making it easy for investors to build a diversified portfolio.

✅ Competitive Pricing: Augusta offers competitive pricing for bullion, ensuring that investors get the best value for their money.

✅ Free Transit Insurance and Shipping: For qualified orders, Augusta provides free transit insurance and shipping, giving investors peace of mind that their investments will arrive safely.

✅ Fees Reimbursement: Augusta offers up to 10 years of fees reimbursed to your IRA in premium Augusta silver coins, further adding value to your investment.

✅ Lifetime Support: Augusta offers account lifetime support, meaning that investors can receive assistance from Augusta far beyond their first transaction. This support ensures that investors have access to expert guidance and support throughout the lifetime of their account.

Augusta Precious Metals Phone Number: 844-917-2904

Augusta Official Website

Unique, free one-on-one educational web conference designed by Augusta’s on-staff, Harvard-trained economist (A must attend)

Augusta free educational Gold IRA Guide:

Get Free Gold Investment Kit From Augusta Precious Metals

#2 – Goldco – Best for Customer Support & Leading USA Gold IRA Company

Do you want to invest in a Gold IRA? Goldco is one of the best-known and most knowledgeable gold companies in America. Goldco has helped investors diversify retirement portfolios using precious metals such as gold and silver for over 15 years. Goldco’s commitment to their customers is what sets them apart. They offer free storage for 5 years, help with Gold IRA rollovers and have no annual fees.

What Goldco offers?

Goldco provides a wide range of investment options, including Roth IRAs, 401(k)s, and other retirement accounts. The team of experts is dedicated to helping navigate you through every step of the investing process. The team also offers a variety of educational resources to help you make educated decisions. Goldco, an investment company, partners with trusted custodians in order to protect your assets.

Get Free Gold Investment Kit From Goldco

Customer Reviews

Goldco is consistently rated highly by customers and industry watchdog organizations. Goldco was awarded A+ by the Better Business Bureau. This indicates that Goldco adheres to high standards in terms of ethical and transparent practices. Goldco’s customer satisfaction rating is 4.89/5. This is a testament to the company’s commitment to providing excellent customer service and protecting its customers’ investments. These ratings demonstrate Goldco’s dedication to providing positive customer experiences and allowing clients to trust them with the future of their finances.

Why choose Goldco?

✅ Goldco offers secure storage for precious metals and gold for as long you own them. You can now invest in precious metals and not have to worry about the logistics involved with storing them.

✅ Support for Gold Backed IRA Goldco supports Gold Backed IRAs, which are a retirement account type that allows you invest in precious metals and gold. This investment type can diversify your portfolio, and provide protection against economic uncertainty.

✅ Goldco’s team of specialists has over 100 years of experience in investing. These experts can guide you through the complicated world of precious metals investment and give advice on what investments would be best for your retirement portfolio.

✅ Goldco is transparent about its policies, procedures and history. You can trust that the company will provide you with honest and reliable information regarding your investments and services.

✅ Goldco’s commitment to exceptional client service and educational materials is evident in the company’s dedication to provide its clients with outstanding customer service. They provide educational materials and other resources to assist clients in making informed decisions regarding their retirement investments.

✅ Gold IRA Rollover – With Goldco you can enjoy Gold IRA Rollover which allows you transfer funds from your existing IRA into a new Gold IRA. This process is tax-free and can diversify your retirement portfolio by adding precious metals.

GoldCo Official Website

Goldco Free investment Kit:

Get Free Gold Investment Kit From GoldCo

American Hartford Gold is a leader in gold IRAs due to its experience, competitive pricing and outstanding customer service. The solid reputation of the company in the gold industry, and its wide array of investment options, caters to all investors’ needs.

What American Hartford gold offers:

American Hartford Gold offers a variety of account options to those who are interested in diversifying with precious metals. There are gold, silver and platinum IRAs as well as Roth, SEP and Simple IRAs. You can choose the account that best suits your financial goals.

You can be confident that your investment is safe and secure when you invest in precious metals through American Hartford Gold. With their range of precious-metal IRA options, investors can diversify their portfolios to protect their wealth from economic uncertainty.

American Hartford Gold also offers Financial Planning Services. This allows investors to create a comprehensive strategy for their investments that will meet their long-term objectives. Their convenient mobile and online banking options make investment management easier.

It is important to know that American Hartford Gold does not have many online reviews from customers and some investments require high minimums. They do not offer a mobile application for account management.

Why American Hartford Gold?

✅ Reputation and Positive Customer Reviews: American Hartford Gold has received numerous positive customer reviews and ratings on platforms like Trustpilot and the Better Business Bureau. This positive reputation indicates a level of trust and satisfaction among its clients.

✅ Largest Retailer of Gold and Silver: American Hartford Gold is recognized as the largest retailer of gold and silver in the United States. This distinction highlights their extensive experience and expertise in the precious metals market.

✅ Diversification and Safe-Haven Assets: Gold and silver are considered safe-haven assets that can help diversify investment portfolios and act as a hedge against market fluctuations and inflatio. American Hartford Gold allows investors to add these safe-haven assets to their investment portfolios, potentially providing stability and long-term value.

✅ Exceptional Customer Service: American Hartford Gold is known for its commitment to exceptional customer service. They prioritize trust, integrity, and transparency in their interactions with clients. Their team of precious metals specialists provides market information and insights to assist investors in making informed decisions.

✅ Buyback Commitment: American Hartford Gold offers a Buyback Commitment, ensuring that investors have easy access to their funds when needed. This commitment provides an additional layer of security and flexibility for investors.

✅ Ease of Use: American Hartford Gold aims to make the investment process simple and user-friendly for its clients. They provide personalized consultations and guidance to help investors understand their options and make informed decisions.

American Hartford Gold, in conclusion, is a great choice for gold IRA investors. They are a great choice for gold IRAs because of their wide selection of options and competitive pricing. Expert advice and guidance from financial advisors with years of experience make them a good option.

Consider American Hartford Gold if you want to protect your financial future by investing in a gold IRA. They are a great choice for investors who want to protect their wealth by investing in precious metals. Their staff is highly qualified, they offer competitive prices, and they provide excellent customer service.

Official Website: www.americanhartfordgold.com

American Hartford Gold Phone: 855-566-2802 (Toll free)

American Hartford Gold Email: [email protected]

Address: 11900 W. Olympic Blvd Suite 750 Los Angeles, CA 90064

American Hartford Gold Kit 2023: Get here

Birch Gold Group has been a prominent player in the precious metals market since its establishment in 2003. Based in Burbank, California, this esteemed company has built a strong reputation for helping customers preserve and grow their wealth through physical precious metals investments. With a focus on understanding each customer’s unique investment goals, Birch Gold Group has gained the trust of numerous individuals seeking financial security.

Diverse Investment Options

One of the key advantages of partnering with Birch Gold Group is the array of investment options they offer. Whether you’re interested in physical metals or prefer to explore the benefits of a precious metals IRA, Birch Gold Group has got you covered. By providing a wide range of investment avenues such as gold, silver, platinum, and palladium, they enable investors to diversify their portfolios effectively.

Commitment to Customer Education

Birch Gold Group stands out for its unwavering commitment to customer education. They understand that informed investors make better decisions, and as such, they provide a wealth of educational resources on their website. From comparisons between physical and paper gold to insights on financial advisors and potential investment scams, Birch Gold Group empowers its customers with the knowledge they need to make informed investment choices.

Customer Ratings

Birch Gold Group is renowned for its exceptional customer service and impressive accolades from reputable sources. With an A+ rating from the Better Business Bureau and a TrustScore of 5 out of 5 based on 121 reviews, they have demonstrated an unwavering commitment to customer satisfaction.

Customers have consistently praised Birch Gold Group for their extensive knowledge and transparent approach in the gold market, empowering clients to make informed decisions with utmost confidence. The level of trust and satisfaction among customers underscores the company’s position as a standout in the Gold IRA industry.

Birch Gold Group’s reputation as a reliable investment opportunity is further substantiated by its positive customer reviews and high ratings. Customers have expressed their satisfaction with Birch Gold Group’s services, highlighting the clear and efficient gold bullion purchasing process. Additionally, their knowledgeable representatives have been commended for providing comprehensive information and assisting clients in making well-informed investment decisions.

Benefits of Working with Birch Gold Group:

✅ Quick and Simple Setup: Birch Gold Group makes it easy for investors to get started with their precious metals IRA. The process is straightforward, and the company provides guidance throughout the entire process.

✅ Excellent Customer Service: Birch Gold Group is well-known for its exceptional customer service. Their experienced professionals are available to answer questions and provide guidance to clients throughout the investment process.

✅ Wide Range of Gold Products: Birch Gold Group offers a wide variety of gold products for investors to choose from. This includes gold bullion, IRA-approved gold coins, and non-IRA eligible gold products. The company also provides access to silver, platinum, and palladium products.

✅ Highly Reputable and Established Company: Birch Gold Group has been in the precious metals industry since 2003 and has built a reputation as a trusted and reliable company.

Visit Birch Gold Group Website

Get Free Gold Investment Kit From Birch Gold Group

Portfolio Diversification: Incorporating precious metals like gold, silver, platinum, and palladium into a retirement portfolio offers an added layer of diversification. These metals have a limited association with conventional asset classes such as stocks and bonds, which can effectively mitigate overall portfolio risk.

Protection Against Inflation: Historically, precious metals have served as a safeguard against inflation. When faced with economic uncertainty or inflationary pressures, the value of precious metals may rise, thus preserving purchasing power.

Potential for Long-Term Growth and Stability: Numerous investors perceive precious metals as long-term investment options for wealth preservation and growth. While these metals may experience their own volatility, they are often viewed as stores of value over time.

Tax Advantages: Self-directed IRAs, also known as Precious Metals IRAs, offer tax benefits by allowing individuals to invest in precious metals within a retirement account on a tax-deferred or tax-exempt basis. Through the utilization of a self-directed IRA, investors can leverage their expertise in physical precious metal investments to enhance their retirement wealth in a tax-advantaged manner.

Tangible Asset with Intrinsic Value: Precious metals possess inherent value derived from their rarity and industrial applications. By investing in physical precious metals through a Precious Metals IRA, individuals can retain these tangible assets as part of their retirement investment, thereby ensuring a certain degree of control and security.

When embarking on the journey of choosing a gold IRA company, there are key steps to follow to ensure you make an informed decision. This article outlines a strategic approach to help you find the best gold IRA company that aligns with your needs and goals.

Step 1: Comprehensive Comparison and Research of Gold IRA Companies

To begin, dedicate time to conducting thorough research and comparing various gold IRA companies. This process will enable you to gather essential information, evaluate their offerings, and assess their reputations. By doing so, you can make an informed decision.

Step 2: Consider Your Budget

In addition to research, it is crucial to consider your budgetary constraints. Evaluate the pricing structures, fees, and associated costs of each gold IRA company under consideration. By doing this, you can determine which company best fits your financial situation.

Step 3: Reflect on Your Gold IRA Investment Goals

Every investor has unique investment goals. Take the time to reflect on your objectives and determine how each gold IRA company aligns with them. Consider factors such as investment strategies, long-term plans, and potential returns. This reflection will help you choose a company that supports your investment aspirations.

Step 4: Inquire with Gold IRA Companies

To gain a deeper understanding of each gold IRA company, pose relevant questions to their representatives. Ask about their track record, customer service, security measures, and any other pertinent information. Their responses will aid you in evaluating their expertise and reliability.

Step 5: Seek Referrals for Gold IRA Companies

One of the most effective ways to assess the credibility and performance of gold IRA companies is by seeking referrals. Reach out to individuals who have experience with these companies and ask for their recommendations. These referrals will provide valuable insights that can guide your decision-making process.

Gold IRA Investing Frequently asked Questions

- What is a gold IRA?

A gold IRA is a specialized individual retirement account (IRA) that allows investors to hold gold as a qualified retirement investment. It can include physical metals like bullion or coins, as well as precious metals-related securities within the portfolio. - What do you get by investing in a gold IRA?

By investing in a gold IRA, you are turning part of your retirement nest egg into gold. It allows you to diversify your portfolio and potentially serve as a hedge against inflation. However, it’s important to note that gold IRAs often come with higher fees compared to traditional or Roth IRAs that invest solely in stocks, bonds, and mutual funds. - How does a gold IRA work?

Gold IRAs work similarly to traditional retirement accounts, but instead of holding paper assets like stocks or bonds, they hold physical gold or precious metals. The investment in physical gold or metals helps grow your retirement savings. - How do I move funds from another retirement account into a gold IRA?

There are two tax-free and penalty-free ways to transfer money between retirement accounts: the 60-day rollover option and the trustee-to-trustee transfer. The 60-day rollover involves receiving a check from your current IRA provider and then sending it to the gold IRA provider within 60 days. The trustee-to-trustee transfer involves directly moving the funds from your current IRA provider to the gold IRA provider. - What are the benefits of investing in a gold IRA?

Some benefits of investing in a gold IRA include diversifying your portfolio, reducing overall risk, and potentially hedging against inflation. Gold has a history of holding value and can provide stability in times of economic instability. - Are there any costs associated with gold IRAs?

Yes, gold IRAs often come with higher fees compared to traditional or Roth IRAs. It’s important to research and understand the fees involved, including custodial fees, storage fees, and transaction fees. These costs can vary depending on the gold IRA company you choose. - Can I invest in other precious metals besides gold in a gold IRA?

Yes, besides gold, you can also invest in other precious metals such as silver, platinum, and palladium within a gold IRA. These metals can provide additional diversification to your portfolio. - How do I choose a reputable gold IRA company?

When selecting a gold IRA company, it’s important to consider factors such as reputation, customer reviews, experience in the industry, fees, storage options, and customer service. It’s advisable to research and compare different companies before making a decision.

Attend a free educational gold IRA web conference (This webinar may change the way you retire …)

A rollover of a gold IRA (Individual Retirement Account) can have tax consequences. Here is an overview of the tax implications associated with a rollover gold IRA based on the provided information:

1. Tax-Deferred Growth: Similar to traditional IRAs, gold IRAs offer tax-deferred growth, meaning that any gains within the account are not taxed until distributions are taken. This allows the investment in gold to potentially grow without immediate tax obligations.

2. Regular Marginal Tax Rates: When distributions are taken from a gold IRA, the gains are subject to regular marginal tax rates rather than the 28% collectible tax rate. The tax rates depend on your income level at the time of distribution. This means that the gains from a gold IRA are taxed as ordinary income.

3. Early Withdrawal Penalties: If you take a distribution from your gold IRA before reaching the age of 59 1/2, you may be subject to early withdrawal penalties in addition to the regular income tax. These penalties are typically 10% of the distribution amount.

4. Contribution and Distribution Rules: Gold IRAs are subject to the same contribution limits and distribution rules as traditional IRAs. It’s important to follow these rules to avoid potential tax consequences.

5. Potential Transaction Fees: When reallocating funds within a gold IRA, such as moving from stocks and bonds to cash or other assets, there may be transaction fees or associated costs involved. These fees are separate from the tax implications but can impact the overall value of the account.

It’s important to note that tax rules and regulations can change over time, and individual circumstances may vary. It is always recommended to consult with a financial advisor or tax professional for personalized advice regarding your specific situation and to stay up to date with the latest tax laws.

Get Free Gold Investment Kit From Augusta Precious Metals – Our #1 Choice for Gold IRA Company

Researching before selecting a company to manage your precious metals IRA is crucial. By comparing reviews and seeking clarification, you can make a more confident decision. Reputable gold IRA companies are transparent, willing to answer questions, and offer valuable benefits. Investing in a precious metals IRA can protect your retirement funds from inflation and enable tax-free wealth transfer. Gold, as a tangible investment, provides security during market turbulence. IRAs offer advantages like secure storage, insurance coverage, and convenience similar to physical gold bullion ownership. Adding gold to your retirement portfolio can enhance stability and security in times of economic uncertainty.

Today, there are several highly regarded gold IRA companies. One of the top choices is American Bullion, which has been assisting customers in rolling over their existing retirement plans into gold IRAs since its establishment in 2009. They provide educational resources and encourage customers to move their investments to gold. Another reputable company is Goldco, known for its high rating, industry recognition, competitive fees, and positive customer reviews. They offer various products to enhance your retirement savings strategy. When selecting a company, consider factors like reputation, fees, metals selection, and buyback policies.

Overall, conducting thorough research and comparing the offerings of reputable gold IRA companies will assist you in making an informed decision tailored to your needs and preferences. Remember to review the latest information and consult with a financial advisor for personalized guidance.

* This is not financial advice. Refer to a professional for investment advice.