Investing in a Precious Metal Roth IRA could offer you potential long-term growth and tax benefits, along with tax-free withdrawals when you retire. But remember, this isn’t your typical IRA; it has unique rules and considerations to consider.

Understanding things like minimum purchase requirements, funding methods, tax considerations, and potential scams before diving in is necessary to ensure you investment is done correctly.

Let’s unpack all you need to know about Precious Metal Roth IRAs so that you can make an informed decision based on your individual investment goals and risk tolerance.

.png?width=1920&height=1080&name=Quick%20Summary%20-%20Gold%20Roth%20IRAs%20provide%20the%20opportunity%20for%20growth%20over%20the%20long%20term%20and%20come%20with%20tax%20advantages%2c%20including%20tax-free%20withdrawals%20during%20retirement.%20-%20If%20you%20want%20to%20invest%20in%20gold%20using%20your%20Roth%20IRA%20(1).png)

A precious metal roth IRA is a type of individual retirement account that allows individuals to invest in tangible assets like gold, silver, platinum, and palladium. In order to set up a precious metal roth IRA, it is necessary to work with a self-directed IRA custodian who will assist in opening the account, acquiring the metals, and fulfilling all IRS reporting requirements.

To gain a better understanding of the potential advantages and disadvantages of investing in gold, it is recommended to download a free wealth protection guide. This resource will help navigate the world of gold investments.

Investing in a precious metal Roth IRA can be a wise strategy for protecting against inflation, expanding one’s retirement account, and diversifying their overall investment portfolio.

By holding physical precious metals, individuals can potentially experience long-term growth and enjoy tax benefits associated with a Roth IRA.

Precious Metal Roth IRA Tax Benefits

One of the main benefits of having a precious metal Roth IRA is that you can make tax-free withdrawals during your retirement.

This means that any profits you earn from your investments will not be taxed when you take out the money in your retirement years. Additionally, a precious metal Roth IRA allows you to transfer funds from other retirement accounts without facing any taxes or penalties.

This can be advantageous if you want to merge multiple retirement accounts or if you wish to add precious metals to your investment portfolio.

Diversification

The value of gold, silver, platinum, and palladium tends to rise when paper currencies lose their purchasing power, making them an effective hedge against inflation.

These precious metals exhibit a low correlation with other assets like stocks and bonds, which means they can potentially enhance returns and decrease overall investment risk.

#1: Goldco

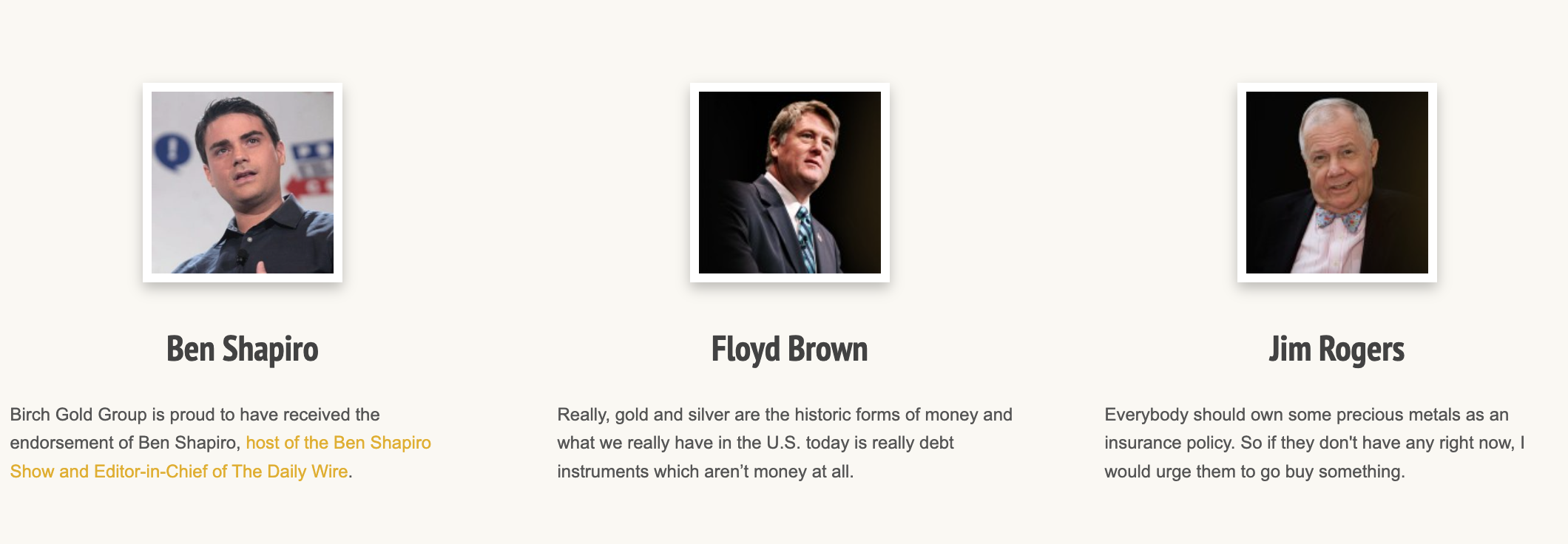

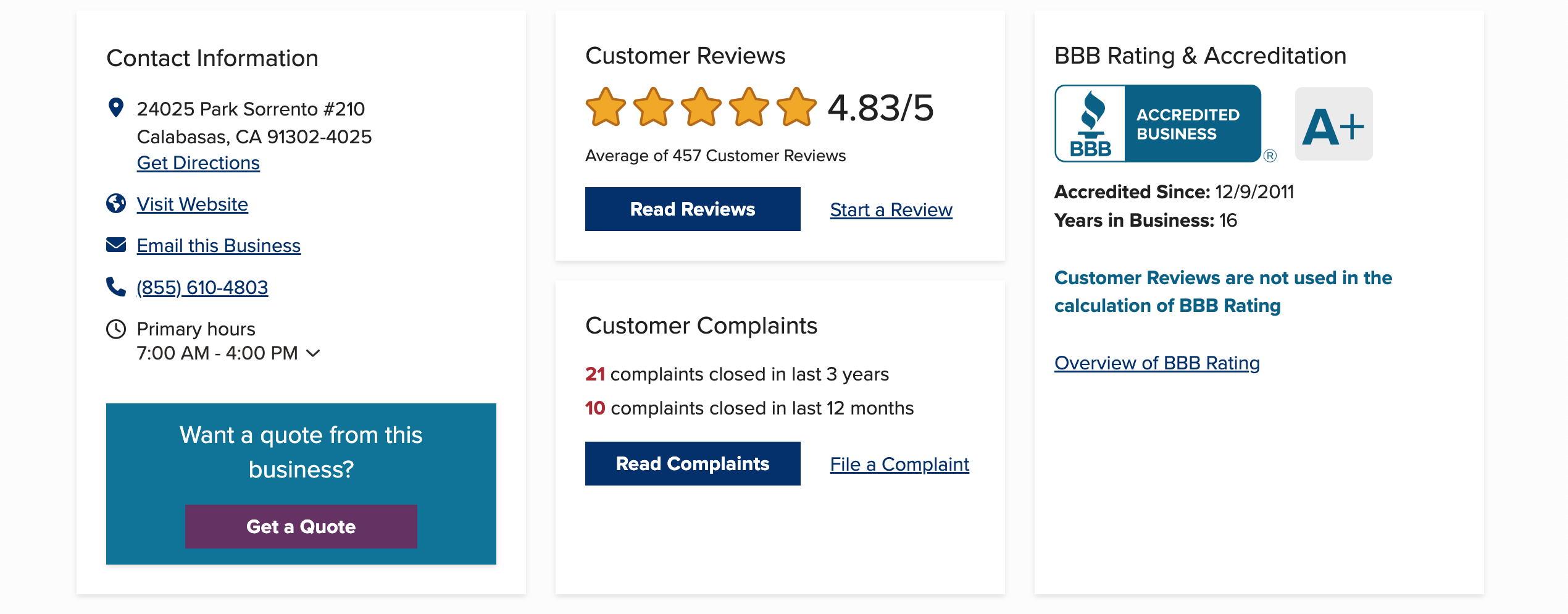

Goldco Precious Metals has been recognized as the top gold IRA company for several reasons; they are known for providing exceptional customer service, being transparent about their fees and processes, and adopting a no-pressure sales approach.

Goldco has been in operation since 2006 and has consistently received highly positive business ratings.

Their clients have also praised their comprehensive customer service, efficient and hassle-free processing, guidance with paperwork, and other factors that set them apart from their competitors.

Goldco places great importance on assisting Americans in safeguarding their wealth during times of economic instability and rising inflation.

The company’s founder, Trevor Gerszt, has a wealth of experience in asset protection, which led him to focus on investing in the most stable and reliable asset in the world: precious metals.

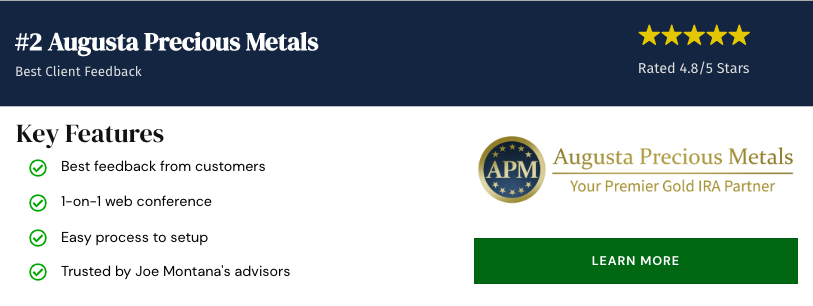

#2 Augusta Precious Metals

One of Augusta’s key strengths is their commitment to education. They offer a unique opportunity for clients to participate in a one-on-one web conference with renowned Harvard economist Devlyn Steele.

This educational session is an integral part of Augusta’s process and aims to provide clients with comprehensive information about the current stock market, inflation levels, the importance of diversification, and personalized investment options tailored to their unique circumstances.

When choosing Augusta as your partner, you can expect to work with true professionals who possess extensive knowledge and experience in the financial sector, particularly in precious metal investing and hedging against market risks.

Augusta’s outstanding business ratings further reinforce their credibility. They have consistently maintained an A+ rating with the Better Business Bureau, an AAA rating with the Business Consumer Alliance, and a 5.0 rating with TrustLink.

In summary, Augusta Precious Metals stands out as a trustworthy and knowledgeable gold IRA company. With their exceptional customer service, commitment to education, and experienced leadership, they are well-equipped to protect your retirement funds from avoidable causes and guide you towards optimal investment opportunities.

#3 American Hartford Gold

American Hartford Gold is a well-known and highly respected brand in the gold IRA market.

Along with other reputable companies like Goldco and Augusta, they have earned a solid reputation and have very few customer complaints.

One of the reasons for their loyal customer base is their efficient and friendly staff, as well as their streamlined process. American Hartford Gold also offers a buyback program, which helps alleviate the perceived risks associated with investing in precious metals. However, it is worth noting that they have very few customers who actually want to sell back their metals, which speaks to the satisfaction and confidence of their investors.

With a track record of delivering over $1 billion in metals, American Hartford Gold can be considered highly experienced in their field. They have earned impressive ratings, including a 5.0 on TrustPilot, an A+ from the Better Business Bureau (BBB), and an AAA with the Business Consumer Alliance (BCA).

American Hartford Gold offers a range of services for portfolio management and also provides rollover services for retirement accounts, regardless of whether they are employer-sponsored or not.

How to Set Up a Precious Metal Roth IRA

#1: Select a reputable Precious Metal IRA company

This is the first step of the investment process. A precious metal IRA company facilitates the entire process and ensures the investment is compliant with IRS regulations.

This ties in with #2, because often times the reliable precious metal IRA companies will already have a partnership with trustworthy custodians, making the investment process seamless.

#2: Choose Your Precious Metal IRA Custodian

As mentioned above, this can be done by either your precious metal IRA company’s recommendation, or by the company of your choice.

A trustworthy custodian will not only ensure that your account remains compliant with IRS regulations but also provide secure storage for your precious metals and offer a wide range of services and expertise.

Two popular gold IRA custodians are Equity Trust Company and STRATA Trust Company.

#3: Fund Your Precious Metal Roth IRA

A Precious Metal Roth IRA allows you to transfer funds from your savings, or rollover your retirement account like a 401k or IRA. From there, you will choose what physical metals you want to invest in which is what your money is backed by.

Precious Metal Roth IRAs VS Traditional Retirement Accounts

When comparing precious metal Roth IRAs to other retirement accounts like traditional IRAs, SEP IRAs, and 401(k)s, there are several similarities.

All of these accounts are designed to help individuals save for retirement and offer tax advantages.

However, precious metal Roth IRAs have some unique features. They allow investors to include physical precious metals in their portfolios and offer the ability to withdraw contributions without paying taxes.

While precious metal Roth IRAs generally have higher fees than traditional retirement accounts, they provide the advantage of diversifying one’s portfolio and protecting against inflation.

Funding Methods

To fund your golden retirement account, you can consider several options such as cash contributions, physical gold investments, gold ETFs, or even a rollover from another type of retirement account.

The most common option is rolling over your current retirement accounts. If you’ve got funds in another retirement account like a traditional IRA or 401(k), you may opt for a rollover into a precious metal Roth IRA without facing penalties.

Investing in Silver and Gold Roth IRA

Diversifying your retirement portfolio with investments in silver and gold can offer financial stability even during times of economic turmoil.

By investing through a Precious Metal Roth IRA, you’re not only building wealth but also safeguarding it against inflation and market uncertainties.

Silver offers an affordable entry point into the precious metals market, while gold’s enduring value has made it a favored asset for centuries.

Platinum and Palladium Investments

Transitioning from silver and gold, let’s explore platinum and palladium investments in your Precious Metal Roth IRA.

These metals offer potentially higher returns but come with greater risks due to their volatility.

Platinum, for instance, can be a lucrative addition to your portfolio thanks to its high demand in the automotive industry.

Palladium also holds promise given its widespread use in electronics. However, these markets are subject to fluctuations that could impact your investment.

Remember, diversification is key! Including a mix of precious metals can help balance out potential losses.

Tax Considerations

Qualified withdrawals are tax-free in this retirement account. This is because you’ve already paid your taxes upfront on contributions.

But remember, if you decide to withdraw your earnings before age 59½ and haven’t had the account for at least five years, there may be a 10% penalty and the withdrawal may be considered taxable income.

Also note that unlike traditional IRAs, Roth IRAs don’t require minimum distributions during your lifetime. However, liquidation of precious metals might be required to pay some taxes or fees.

Always consult a tax advisor for any decisions related to your retirement accounts and investments.

Making the Decision

With potential long-term growth, tax benefits, and protection against inflation offered by Precious Metal Roth IRAs, it could be a wise move.

Consider your financial goals before making the leap. Also, thoroughly research any company you’re considering for investment. Companies like Goldco or Augusta Precious Metals are highly rated but do require minimum investment amounts. Goldco’s minimum is $25,000 and Augusta’s is $50,000.

Ultimately, choosing a Precious Metal Roth IRA is about securing your future. Make an informed choice and you could create a robust nest egg for your golden years.

Frequently Asked Questions

What is the process to rollover a traditional IRA to a Precious Metal Roth IRA?

To rollover a traditional IRA to a precious metal Roth IRA, start by setting up a self-directed Roth IRA with a reputable custodian.

Next, initiate the rollover process from your current IRA account. You’ll likely need to pay taxes on the amount you’re converting since Roth IRAs use after-tax dollars.

Once completed, you can then invest in approved precious metals.

Remember, it’s crucial to consult with a financial advisor before making such decisions.

How long does it typically take to set up a Precious Metal Roth IRA?

Setting up a Precious Metal Roth IRA doesn’t take too long. Typically, the process can be completed in a few days to a week.

This timeline includes time needed for application processing and account setup by your chosen custodian. However, keep in mind that transferring funds from an existing account or making an initial deposit could add some extra time.

So, plan accordingly to ensure everything goes smoothly with your new investment strategy.

Can I contribute to a Precious Metal Roth IRA if I already have a traditional IRA or 401(k)?

Absolutely! You can contribute to a Precious Metal Roth IRA even if you already have a traditional IRA or 401(k). However, keep in mind that there are annual contribution limits set by the IRS. So, you’ll need to ensure your total contributions don’t exceed these limits across all accounts.

Also, remember each retirement account comes with its own set of rules and potential tax implications. Always consult with a financial advisor before making decisions about multiple retirement accounts.

What are the annual contribution limits for a Gold Roth IRA?

The annual contribution limits for a Roth IRA depend on your age and income. If you’re under 50, the limit is $6,000 per year. If you’re over 50, it jumps to $7,000. However, these numbers can change if your income surpasses certain thresholds.

Remember that investing in gold through a Roth IRA follows the same rules – whether the investment is made in cash or precious metals like gold doesn’t affect the contribution limit.

Can I transfer or rollover existing retirement accounts into a Gold Roth IRA?

Absolutely, you can transfer or rollover existing retirement accounts into a Gold Roth IRA. This includes traditional IRAs, 401(k)s, and even other Roth IRAs. However, be aware that there might be taxes or penalties depending on the type of account you’re rolling over from. It’s always wise to consult with a tax advisor before making any major financial decisions like this one.

What is the process of liquidating a Gold Roth IRA and how long does it take?

To liquidate your Gold Roth IRA, you’ll first need to contact your custodian and request a distribution. They’ll typically require a form to be filled out.

After submission, the custodian will sell your gold at the current market value and send you a check or direct deposit.

The process can take anywhere from a few days to several weeks depending on the efficiency of your custodian and market conditions.

Are there any age restrictions for investing in a Gold Roth IRA?

Yes, there are age restrictions for investing in a Gold Roth IRA. Unlike traditional IRAs, which impose required minimum distributions at age 72, Roth IRAs have no such requirements. You can contribute to your Roth IRA at any age as long as you have earned income from work. However, keep in mind that income limits may affect your ability to contribute, and the IRS caps annual contributions regardless of your age. Always consult with a financial advisor for personalized advice.

What happens to my Gold Roth IRA in the event of my death?

If you pass away, your Gold Roth IRA doesn’t just disappear. Instead, it transfers to your designated beneficiaries. You can choose anyone—family members, friends, or even organizations—to receive this benefit.

The account continues to grow tax-free until your beneficiaries decide to withdraw the funds. However, they may be required to take minimum distributions based on their life expectancy or deplete the account within a certain time period depending on IRS rules.

What happens to my Precious Metal Roth IRA if the market price of precious metals crashes?

If the market price of precious metals crashes, your Precious Metal Roth IRA value could decrease significantly. However, remember that investing in a Roth IRA is generally for long-term growth. While short-term volatility can be unsettling, it’s crucial to focus on your retirement goals and not make impulsive decisions based on temporary market downturns.

Always consult with an experienced advisor before making major investment decisions during these times.

How can I ensure that my precious metals are stored safely and securely in a Precious Metal Roth IRA?

Choosing the right custodian for your Precious Metal Roth IRA is crucial to ensuring your precious metals are stored safely and securely. Look for a custodian with a strong reputation, robust security measures, and insurance coverage.

Your metals should be stored in an IRS-approved depository that offers segregated storage. Regular audits can also provide additional peace of mind.

It’s important to do thorough research before entrusting your assets to any company.

Conclusion

Ultimately, whether a Roth gold IRA is worth it depends on your current investments and whether or not you are already diversified in assets with intrinsic value.

A gold and silver Roth IRA can offer various advantages, such as diversifying your portfolio, protecting against inflation, and providing tax benefits.

By conducting comprehensive research and finding the right precious metal Roth IRA company, you can make an informed choice and secure a brighter financial future.